Table of Content

If you need short-term, skilled nursing care to recover from an illness or injury, Medicare Part A’s home health benefit might cover you. If you’re recovering from a hospital stay, Part A’s skilled nursing facility coverage might cover your needs. Your Medicare-assigned doctor can recommend the kind of care you need and help place you in the appropriate situation. However, you should expect to pay anywhere between $120 and $550 per month.

One covers your personal belongings and liability when you live in a nursing home. The other helps you cover the costs of living in a nursing home, should you ever need to. Pregnancy-related costs are often not covered by accident and illness or wellness plans.

Types of Insurance You May Need

Cats need two to three energetic, 10 -minute play sessions daily. And some breeds, such as Bengals and Siamese cats, require even more exercise as they’re prone to become destructive if they have too much energy to burn. Depending on the coat length, some cats require daily brushing, but most cats only need to be bathed if they get dirty or have allergies.

If you are working with an accountant or some other retirement planner, mention that you are considering nursing home insurance. They will be able to crunch the numbers and determine whether this policy makes sense for you or your loved ones. Working with an independent agent will help direct you toward the best providers for this type of policy.

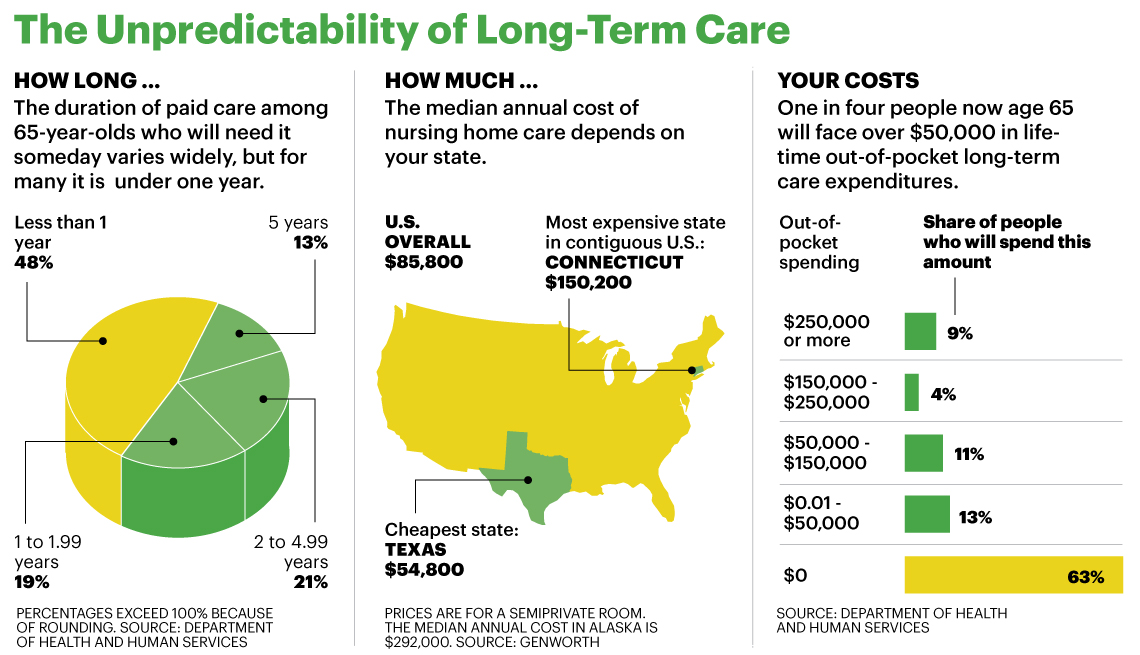

How much does nursing home care cost?

While Medicare doesn’t offer a lot of support for long-term stays in nursing facilities, other options are available, depending on your history, financial situation and other qualifications. Most often, eligibility is based on your income and personal resources. Many states have higher Medicaid income limits for nursing home residents. You may be eligible for Medicaid coverage in a nursing home even if you haven’t qualified for other Medicaid services in the past. Private long-term care insurance may provide some benefits for long-term care residents but coverage varies depending on the company and policy. In addition to all of these factors, the specific type of assistance that your elderly loved one requires will also affect the price.

The amount of the allowance varies depending on your living arrangements, type of nursing facility, and state rules. If you are married, an allowance may be made for the spouse still living in the home. Medicare pays 100 percent of skilled nursing facility services for the first 20 days. On days 21 through 100, the beneficiary is likely responsible for a copayment. After 100 days, the beneficiary may be responsible for 100 percent of all costs.

Does Medicaid Cover the Costs of a Nursing Home?

For instance, Medicare wont cover a private nurse unless its deemed medically necessary. You can discuss your treatment with your healthcare provider to help ensure that the services they recommend are covered. Medicare Part A partially covers costs at an SNF for the first 100 days of each benefit period. A benefit period begins on the day that youre admitted as an inpatient to the SNF or hospital.

Annual premiums start at $1,300 if you are younger than 50 and steadily increase, especially after you reach 60. Similar to regular health insurance, long-term care insurance has you pay a premium in exchange for financial assistance should you ever need long-term care. This insurance can help prevent you from emptying your savings if you suddenly find yourself needing nursing home care. However, it’s important to note that these policies often have a daily or lifetime cap for the amount paid out.

What Is Medicare Part F Supplemental Insurance

With the average lifespan increasing, many older people find themselves in assisted living facilities for many more years than they anticipated. Your savings has to last you for the remaining years you live in your home and get to travel and spend time with family, but also for your final years when you may require significant care. This new dynamic significantly changes the amount of money most people need for retirement. Many people will purchase these policies at a younger age, such as in their 50s, as the premiums usually increase in cost as a person ages.

If you purchase insurance for your contents in the nursing home, ask the same insurer about the liability coverage. The value of the contents and the type of contents will also impact what kind of insurance you need. Some people just need coverage for standard personal belongings, others may be looking to specifically insure high-value items like jewelry and watches or furs. When living in a nursing home, several factors come into play to determine if you or your family member needs to buy special insurance to cover contents and personal belongings. Learning about the options for nursing home insurance to save money long term. Mila Araujo is a certified personal lines insurance broker with more than 20 years of experience in the insurance industry.

Muscle mass decreases, eyesight deteriorates, cognitive health can decline; there are a number of complications that a person can experience as they age. If you or your loved one has Medicare Part D, your medications will typically be covered even if you live in a long-term care facility. This is because Medicare does not consider these things to be medically necessary. Unfortunately, what they also do not see as medically necessary are custodial care and long-term nursing home placement.

For that, they willhave to considersome of the alternatives listed below. Medicare caps coverage for a skilled nursing facility at 100 days. Any charges for time beyond that are the responsibility of the patient. Depending on your coverage, nursing home insurance pays between $100 and $500 a day for the daily expenses of your long-term care. That means the cost of living in a facility or at-home nurses, cleaning, and other additional assistance.

Medicare coverage for in-home nursing care doesn’t usually include meals, homemaker services, or round-the-clock nursing. Custodial care isn’t covered if this is the only kind of care you need. Custodial care refers to personal assistance with daily living activities, such as bathing or getting dressed. These tasks are usually performed by home health aides and don’t require a medically trained nursing or rehabilitation team. In order to find out if your family member’s health insurance will cover any of the cost, speak to a representative of the company.

Other examples include physical/occupational/speech therapies and an annual flu vaccine shot. The following are some suggestions to help you understand nursing home insurance cost and make sure you get the coverage you need at a good price. We explain what home health services Medicare covers, how to qualify, costs, and more. Medicare usually only covers short-term skilled nursing care in a nursing home.

No comments:

Post a Comment